fha gift funds cousin

With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

What S The Deal With Gifts And Grants And How Do I Get My Hands On Them Beeline

Gifts toward down payment do not have to always be in cash.

. FHA 40001 Gift guidelines clarification 04272017. Not like adoptive parents or someone who saved your life or some bullshit like that. There are strict rules and regulations with FHA Guidelines On Gift Funds.

However the FHA does allow for gifts from close friends and under those. Gift funds are a very popular way of paying a down payment or for paying closing costs pre-paids when purchasing a home. For example a man could sell his house worth 100000 to.

Borrowers with a credit score of 580 or higher need 35 of the homes value as a down payment. We received clarification from HUD that the red items are required when sourcing donor funds. The minimum amount you can receive as a gift is 500 and there is no maximum.

The portion of the gift not used to. Its so unclear and. However the FHA does allow for gifts from close friends and under.

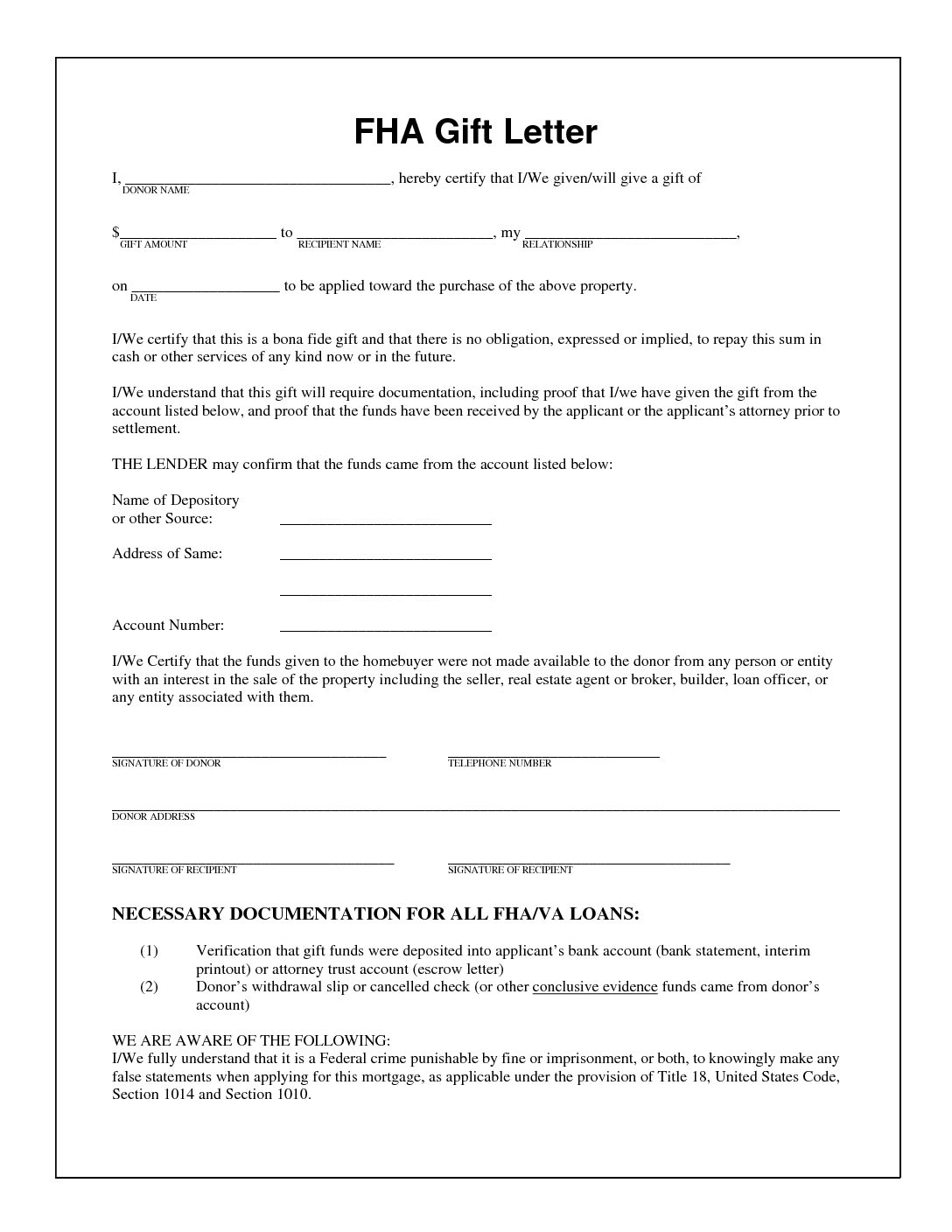

If it says close friends are ok to gift then that should really mean any close friend. Provide executed gift letter. The FHA guidelines permit an eligible donor to gift some or all of the home-buying expenses including the down payment.

On most mortgage loan programs a gift is an. The FHA Gift Fund can be used for both the down payment and closing costs on your home. If you have applied for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that.

Does FHA allow a gift from a. Who can gift funds for an FHA loan. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

This is much lower than a. However the FHA does allow. Borrowers with a credit score of 500 579 need a down payment of at least.

The borrower isnt required to put any of his or her own funds when receiving a gift that takes care of the full down payment and closing costs unless the final loan amount is over. FHA loans requires that borrowers who receive a Gift of Equity must have a minimum down payment of 35 percent of the homes final purchase price. The FHA doesnt just list who may give such a gift--it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment.

Can a cousin gift funds on an FHA loan. In order to establish whether a particular gift of down payment money is permitted we have to examine what the FHA describes as a bona fide gift. According to HUD 41551.

A family member can also use equity in a property as gift funds. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins. FHA Guidelines On Gift Funds state that home buyers can get 100 gift funds to purchase their home.

Documenting the Transfer of.

How To Use Gift Letters For Your Mortgage Rocket Mortgage

Fha Loan With A Cosigner Requirements 2022 Fha Lenders

Down Payment Gifts And How To Use Them

Down Payment Gift Rules From A Friend Or Relative

Down Payment Gifts And How To Use Them

Fha Gift Funds How Can I Use Them To Buy A Home

Gift Letter Document Gift Funds For Fha Or Conventional Loans

Using Gift Letter For Mortgage Gift Letter Template Guaranteed Rate

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Loan Rules For Gift Funds Fha News And Views

Fha Gift Letter Fha Va No Tax Return Bank Statement Mortgage Lenders

Do S And Dont S Of Homebuying With Gift Funds Find My Way Home

Gift Money For Down Payment And Gift Letter Form Download

Guide To Down Payment Gifts Seattle Mortgage Planners

Do S And Dont S Of Homebuying With Gift Funds Find My Way Home

:max_bytes(150000):strip_icc()/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)